Analyzing and Optimizing Client Portfolios using SQL Server: Unveiling Insights for Data-Driven Decision Making

Overview:

In this project, I conducted an in-depth analysis of client portfolios for Wells Fargo's Private Bank, utilizing SQL queries and data analytics techniques. The primary objective was to provide valuable insights and recommendations to optimize portfolio performance and manage risk effectively.

Methodology and Objective:

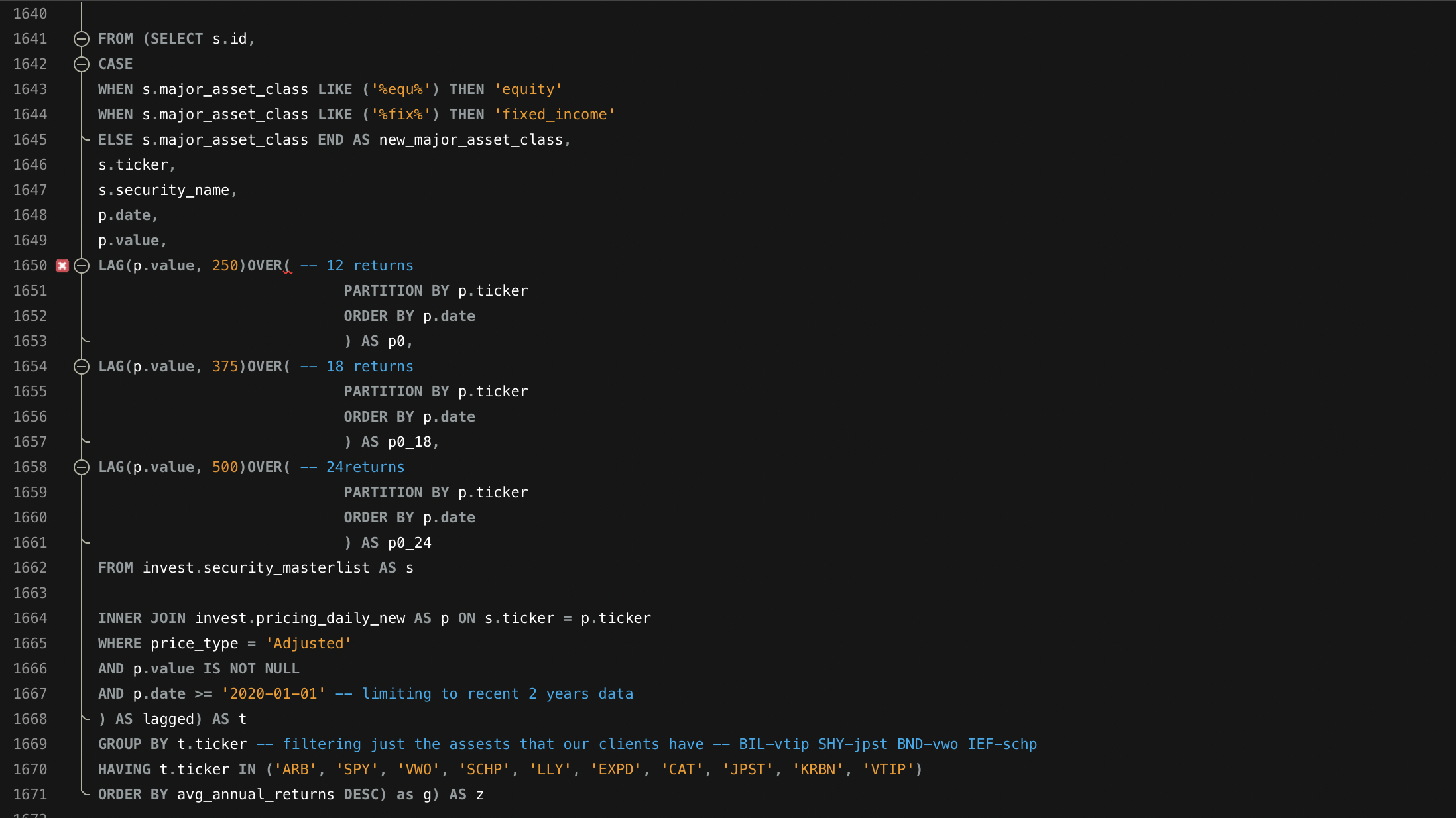

To accomplish the objective, I followed a systematic approach that involved gathering client portfolio data, categorizing securities based on various criteria, calculating performance metrics, assessing risk levels, and evaluating asset allocation. By leveraging SQL queries and financial expertise, I analyzed the portfolios to identify areas of improvement and develop tailored recommendations.

Please note that the names used for the clients in this project are fictional and have been created for illustrative purposes.

Key Findings:

During the analysis, several key findings emerged from the client portfolio data:

Diversification Gap: Many portfolios lacked sufficient diversification, with an overconcentration in certain asset classes or individual securities.

Performance Disparities: Significant variations in performance were observed across different securities and asset classes.

Risk Assessment: Risk levels varied among portfolios, with some exhibiting higher risk profiles than desired.

Key Takeaways:

Based on the analysis, the following key takeaways were identified:

Emphasize Diversification: Recommending the inclusion of a diversified range of securities to mitigate risk and improve long-term performance.

Performance Optimization: Suggest adjustments to portfolio allocations by identifying well-performing securities and opportunities for improvement.

Risk Management: Proposing risk mitigation strategies, such as rebalancing asset allocations and considering alternative investment options.

Client Portfolio Analysis - Client 740: For client 740, the analysis revealed insights into their portfolio's expected returns over 12, 18, and 24 months. The expected returns were calculated based on the client's holding weights for each asset and the average returns of those assets over the specified periods. The analysis indicated the following expected returns for client 740's portfolio:

Please note that the names used for the clients in this project are fictional and have been created for illustrative purposes.

Client Portfolio Analysis - Client 497: For client 497, the analysis provided insights into their portfolio's expected returns over 12, 18, and 24 months. The expected returns were calculated by considering the client's holding weights for each asset and the average returns of those assets over the specified periods. The analysis indicated the following expected returns for client 497's portfolio:

Please note that the names used for the clients in this project are fictional and have been created for illustrative purposes.

Client Portfolio Analysis - Client 539: For client 539, the analysis yielded insights into their portfolio's expected returns over 12, 18, and 24 months. By analyzing the client's holding weights and the average returns of individual assets, the following expected returns were determined for client 539's portfolio:

Please note that the names used for the clients in this project are fictional and have been created for illustrative purposes.

Client Portfolio Analysis - Client 684: For client 684, the analysis provided valuable insights into their portfolio's expected returns over 12, 18, and 24 months. By considering the client's holding weights and the average returns of various assets, the following expected returns were calculated for client 684's portfolio:

Please note that the names used for the clients in this project are fictional and have been created for illustrative purposes.

Conclusion:

In conclusion, Wells Fargo Private Bank's client portfolio analysis project provided valuable insights into portfolio composition, performance, and risk levels. By leveraging SQL queries and data analytics techniques, I identified areas for improvement and developed actionable recommendations to optimize portfolio performance and manage risk effectively. This project showcases my data analysis, financial analysis, and strategic thinking expertise.

In this project, I utilized a Relational Database Management System (RDBMS), specifically SQL Server, to analyze data and generate insights for the client portfolio analysis. SQL Server allowed me to efficiently store, manage, and query large datasets, enabling me to extract meaningful information from the available data.

I employed various SQL querying techniques throughout the analysis, including joining tables, aggregating data, and utilizing temporary tables. These techniques helped me organize and manipulate the data to derive valuable insights.

By showcasing my SQL Server proficiency and ability to effectively query and manipulate data, I demonstrated my strong foundation in database management and data analysis techniques.